Nonprofit Accounting

How to Choose Nonprofit Accounting Software — A Complete Buyer’s Guide and Questions to Ask

Table of Contents

Having a clear, step-by-step approach is necessary to find the right nonprofit accounting software for your organization. A structured method can guide you through the process.

For example, there are over 139 accounting software platforms on TrustRadius alone. Making the right choice from so many options — especially as a nonprofit organization or government institution — requires careful decision.

Here’s why — as a nonprofit, you have different accounting guidelines you must adhere to. You also have more budgeting, planning, auditing and reporting constraints than commercial organizations.

To run your operations efficiently and ensure proper donor dollar management, transparency, accessibility and flexibility of accounting systems, you need anonprofit fund accounting system.

Why You Need Nonprofit-Specific Accounting Software

Nonprofit-specific accounting solutions are purpose-built for nonprofit organizations to organize, budget and track their funds. Rather than adapting from existing solutions, nonprofit accounting software considers the essential differences between nonprofit accounting and regular business accounting.

Some of these differences include:

- The mission of the funds: Unlike private and commercial organizations, nonprofit organizations focus on civil and humanitarian goals.

- Fund restrictions, regulatory compliance and control: Unlike private and commercial organizations — which sell products or services to their customers — nonprofits rely on donations from supporters to fund their missions. Therefore, nonprofits have many restrictions on how to use and report funds.

The best accounting software for nonprofits accounts for these differences.

Additionally, according to our nonprofit finance study, 79% of nonprofits plan to grow in the next 12 to 18 months. Your organization can prepare for the future by managing your funds with an accounting software solution built with growth in mind.

For example, if you’re currently using QuickBooks, spreadsheets or other general accounting software, you will quickly outgrow it. Getting a nonprofit accounting solution — that will grow with your organization and meet both your short- and long-term needs — will save time, money and stress on finding workarounds for tools not fit for your organization. It also saves you from the data-security risk of moving your financial and donor data from one solution to another.

Then, what mistakes do most nonprofits make when choosing nonprofit accounting software?

Things to Avoid While Choosing a Fund Accounting Software Platform

Whether you’re trying to leave the spreadsheets and transition to nonprofit accounting software, or your current fund accounting solution is not cutting it for your organization, you should avoid these common pitfalls when choosing a new solution for your nonprofit organization:

- Using the first fund accounting software you find: Settling for the first fund accounting software you see seems convenient. However, you may lose more time and resources trying to tweak the software to your needs or finding a new accounting platform if that one doesn’t work as intended.

- Using price as a major deciding factor: Buy a platform according to your budget, but do not start with it. When searching for nonprofit accounting software for your organization, focus on the features you’re looking for and the problems you’re trying to solve.

- Buying just for the present: Focusing on solving only your current needs will hurt your organization in the long term. Your organization will grow and gain more complex accounting needs, and it will soon outgrow your software solutions if they do not expand with your operations.

- Hurrying the selection process: Buying nonprofit fund accounting software can take long hours and days based on what you’re looking for. However, investing the needed time to ensure your organization’s financial security is worth it.

- Switching regularly between solutions: Searching for a new software solution, training your team and transferring your business data wastes time and resources that you could utilize in achieving your mission. It also exposes your business data to security risks. Limit the number of times your organization switches solutions by finding accounting software that works in the present and prepares you for the future.

Below, we will take you through the process you need to follow and the key questions to ask to choose the best nonprofit accounting software for your organization.

Why You Need to Choose the Right Accounting Software

Choosing the right fund accounting software for your organization:

- Saves you significant time in finding workarounds for software that doesn’t fit your needs.

- Helps you effectively manage donor dollars, boost trust and transparency and prevent mistakes and errors.

- Makes fraud and financial mismanagement easy to detect.

- Makes it easier to conduct audits and report on your financial activities.

- Supports budgeting and planning activities more effectively.

How do you choose the right fund accounting software for your organization? By asking and answering key questions.

5 Questions to Ask Before Choosing a Nonprofit Accounting Software

Whether you’re looking to purchase nonprofit accounting software now or are planning for your organization’s future, you need to get the basics sorted out.

Here are 5 crucial questions you must answer before choosing a nonprofit accounting solution for your organization:

1. What Features Do You Currently Enjoy?

What features — including ones crucial to your operations — does your current accounting solution provide? Make a list of them. Your new platform must have these features to best serve your organization.

2. What New Functionalities Do You Need?

What accounting problems do you want to solve within your organization? List out the features in an accounting solution that will solve these problems. Keeping track of them within one organized platform will make it easier to stay up to date with existing problems and potential solutions.

3. What Plans Do You Have for the Future?

How much would you grow in the next five to 10 years? Will you engage in more projects, get more donations or hire more staff? What new accounting functionalities would help you meet these new needs?

For example, if you plan to grow your workforce from 10 to 100 staff in five years’ time, you need an accounting tool that enables more complex payroll management. Purchasing a new accounting software with integrated nonprofit human resource management (HRM) and payroll and letting your organization grow with the software will save you time and finances. You can eliminate the risk of exposing your data from migrating to a new tool when the time comes.

4. Do You Want a Cloud-Based or On-Premise Solution?

Do you want your accounting software running on your desktop, or do you want to move your accounting to the cloud? Weigh the pros and cons of cloud-based vs. on-premise software to decide which will work best for your organization.

5. What Is Your Budget?

How much does your organization have to spend on fund accounting software? Your budget will decide the software solution you finally select.

Answer this question — and all the ones above — on paper. They will constitute your requirements when choosing the best accounting software for nonprofits.

The next step involves searching for nonprofit accounting software vendors that meet your requirements.

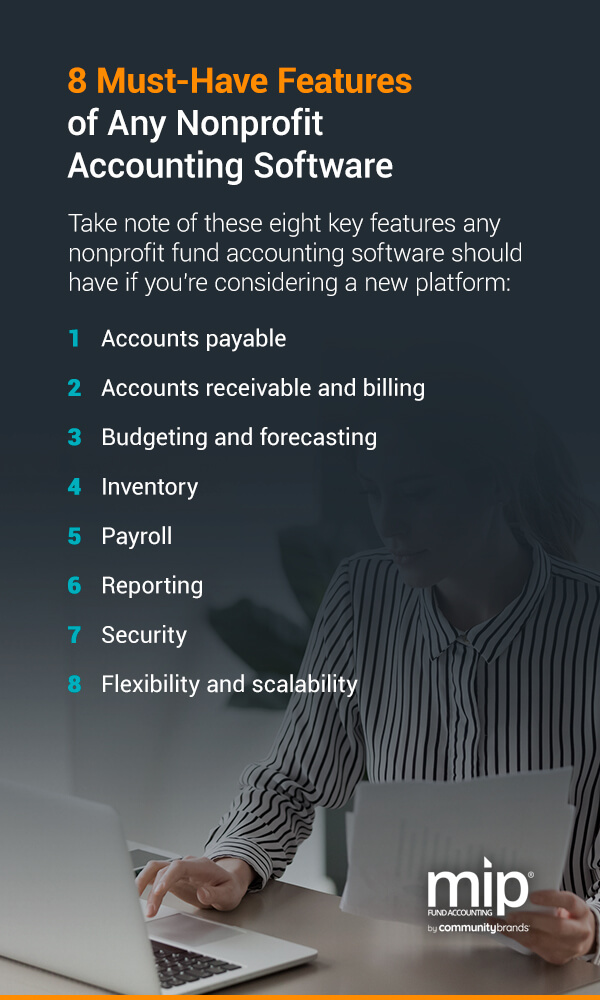

8 Must-Have Features of Any Nonprofit Accounting Software

Take note of these eight key features any nonprofit fund accounting software should have if you’re considering a new platform:

- Accounts payable: This feature is necessary for vendor records management, payment date calculation, suspicious payment alerts, advance payment scheduling and accounts payable document attachment.

- Accounts receivable and billing: This feature helps with effective invoice creation, balance-forwards, sales tax calculation and invoice duplication.

- Budgeting and forecasting:Take advantage of budgeting and forecasting with what-if scenarios, versioning and approval.

- Inventory: Inventory features help with serial number and lot tracking, price management and landed costs.

- Payroll: Payroll assists with time and attendance tracking, employee self-service, prevailing wages and certified payroll.

- Reporting: Reporting features include budget-to-spending comparisons, grants, contract and project accounting and fund management.

- Security: Security features are always necessary for role-based authentication, encryption, locked reporting periods and backup recovery.

- Flexibility and scalability: Having these two elements enables different payment plans and lets you select the features you need.

The software should be constantly updated and accessible for different users. It should also seamlessly integrate with other software tools you use, provide 24/7 technical and customer support and allow for easy data migration and portability.

All these features will help you carry out four crucial functions to set your nonprofit organization up for success.

4 Crucial Functions Your Nonprofit Accounting Software Solution Should Facilitate

Look for these four organizational functions that any nonprofit accounting software solution must be able to carry out:

- Making informed decisions and preparing for the future: Look for nonprofit accounting software that offers a customized ledger to track your funds. The customized ledger should make it easy for you to track your funds, from restricted or unrestricted to specialized fund groupings. It should help you make data-driven decisions regarding investments and fundraising.

- Budgeting and forecasting: Your accounting software should offer customized budgeting capabilities to create and monitor a plan for financing campaigns for the present fiscal year and forecasting for the future.

- Carrying out advanced internal control and audit trails: Your nonprofit accounting solution should enable you to handle internal day-to-day tasks such as employee payroll, timesheets, human resource management, reporting and auditing.

- Maintaining accounting compliance with GASB and FASB: Your accounting software solution should help you create custom reports to maintain comprehensive records. These reports should also have Financial Accounting Standards Board (FASB) and The Governmental Accounting Standards Board (GASB) standards built-in for easy auditing.

After finding software vendors that can help you carry out these crucial tasks, request a demo or meeting to see how the software solutions align with your organization’s needs. Here are eight questions you can ask to get the ball rolling.

8 Questions to Ask Sales or Tech Support for Accounting Software Vendors

Asking these eight questions will help you buy the right solution for your organization and adhere to industry best practices:

- How much time will the software save my organization? Software solutions help you reduce manual work and complete tasks more quickly. How much time will the tool help you save and how?

- How will the software help manage cash flow? The software should enable your organization to manage payables, receivables, invoices, funds allocation and more. How effective will the accounting software be at helping you maintain cash flow? What automation features does the solution have?

- What other software programs does the platform integrate with? These platforms may include fundraising, donor management, payroll and more. What other third-party apps does your chosen solution natively integrate with?

- How do I migrate my existing data? Can you automatically migrate your existing operational data, or would you have to enter this information manually? Completing forms takes up time you could use for other important tasks.

- How quickly can I go live? How long will it take for you to get set up and start using the solution? Time is of the essence when managing an organization.

- How does the software help progress my goals? Does the platform have all the features on your list? If not, what plans do the vendors have to include these features in the future? How fast does their customer support team respond to customers’ needs?

- How secure is the software? Software security is essential for protecting personal and business information.What security measures does the software implement? Are there permission levels for multiple users? What security firewalls are implemented to secure your funds and donor information?

- What does the software cost? Make sure you know all hidden and future charges. Knowing the cost will ensure you do not pay for features and modules you do not need. This way, you can be sure of the upfront cost and stay within your budget every step of the way.

Use your answers to:

- Compare the features and capabilities of each solution against your needs.

- Weigh the pros and cons of each solution.

- Consider the compromises your organization can make regarding cost and features.

- Do the above steps with key stakeholders and come to a consensus.

- Reach out to your chosen nonprofit fund accounting software vendor.

Comparing the 3 Best Accounting Software Platforms for Nonprofits in 2021

Intuit Quickbooks, Financial Edge and MIP Fund Accounting® are three of the top nonprofit accounting solutions in the market. Here’s how they compare.

| Intuit QuickBooks | Financial Edge by Blackbaud | MIP Fund Accounting® | |

| Overview | Inexpensive with all the features new nonprofits need to get started. However, you may find it limiting as you begin to grow. | Very effective when integrated with other Blackbaud products, such as Raiser’s Edge. | Built specifically for nonprofit organizations, with features that easily manage financial complexities.

. |

| Capabilities |

|

|

|

| Best for you | QuickBooks is best if you’re just starting, but you may outgrow it quickly. | Financial Edge is best if you’re already on the Blackbaud platform. | MIP® is best for all nonprofits. It’s scalable to meet the needs of any size organization. |

MIP Fund Accounting® Is Purpose-Built for Nonprofits

MIP Fund Accounting® is a comprehensive, configurable system for financial management and informed decision-making. It focuses on nonprofit organizations and government entities to support the complexity of financial management inherent to their structure. Our platform is flexible, scalable and secure, offering everything nonprofits need for fund accounting.

Our platform is purpose-built for nonprofits and anticipates their reporting and accountability requirements rather than adapting to their needs from existing solutions. Our support team — consisting of individuals who have worked with MIP for 20-30+ years — is available 24/7 to assist you with your accounting needs.

MIP® accounting software provides:

- Built-in FASB and GASB compliance.

- General ledgers.

- Dashboards.

- Accounts payable and receivable.

- Bank reconciliation.

- A budgeting forms designer.

- Advanced security.

- Electronic requisitions.

- Fixed assets.

- Encumbrances.

- Human resource management and employee web services.

- Integrated payroll.

- Benefits enrollment.

MIP® gives you a flexible chart of accounts that records and reports on multiple funding sources. It allows you to manage every aspect of your finances from a single software solution. Whatever your long-term goals may be, you can scale and configure your software — on-premise or cloud-based — to your unique needs.

Request a demo today to try our solution before you buy. If you need more information to make your decision, contact our sales and customer support team